Many people can become very frustrated with themselves when they feel like they are putting in the hard work only to find that they are not getting to a place where they want to be. One example of this is when people are applying for an unpaid job after they have completed their studies and everywhere they apply seems to turn them down or they simply do not hear from them at all. Whatever the case may be when people are feeling this way it can become very easy for them to start to feel deflated and perhaps like something is wrong with them.

But people need to understand that there is nothing wrong with them and that they just need to implement a different strategy along the way. And thankfully, there are lots of great strategies out there that people are able to implement. As an applicant will want to give themselves the best competitive edge that they possibly can, here are some quick tips that you can implement when you are on the hunt for the best accounting internships.

One instance of a quick tip that you can implement when you are on the hunt for accounting internships is to set up email reminders

One instance of a quick tip that you can implement when you are on the hunt for accounting internships is to set up email reminders. And this can be a good idea because when people are simply trying to login to their favourite job search websites each day, they may find that they miss something or that they do not come across something until it is too late. The good news is that when people sign up to get reminders from all of these different websites, new positions and roles can be emailed straight to them and they don’t have to worry about missing out.

Furthermore, they are going to get these new opportunities sent to them right away which means that they can also apply right away and are able to get in before their competitors. Be this as it may, it can increase the chances of getting a great role instead of spending weeks or perhaps months trying to find the perfect option. And this also means that people will be one step closer to obtaining a paid position for themselves too.

Another instance of a quick tip that you can implement when you are on the hunt for accounting internships is to have a draft cover letter and resume ready to go

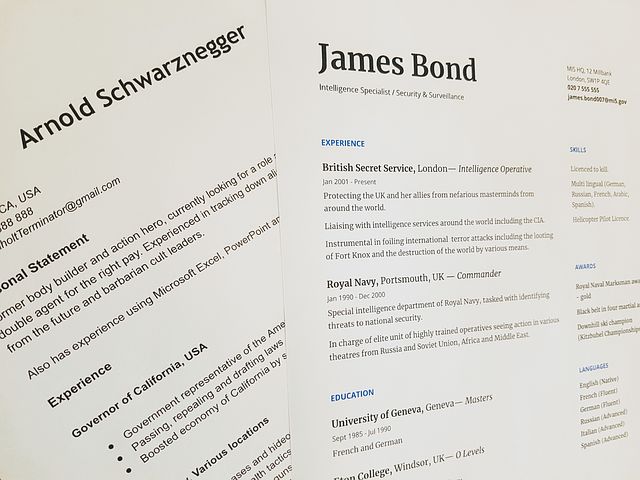

Another instance of a quick tip that you can implement when you are on the hunt for accounting internships is to have a draft cover letter and resume ready to go. This is because people will never be caught off guard and it also means that people are able to apply quickly. It is important to note, however, that people should slightly change what they are submitting to the company so that it is unique to them.

For example, they may want to look up their team motto and include this somewhere in their cover letter. Many companies out there will get sent thousands of resumes each month and so it is important to make sure that they are not just generic. At the end of the day, implement small techniques such as the ones described in this post can be a wise move when it comes to finding the perfect position and when it comes to standing out from other resumes that are submitted.